GREAT..Dividend Discount Model Ppt

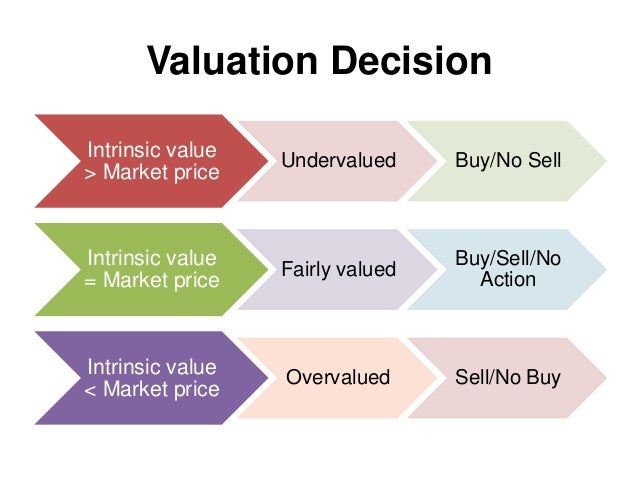

Present value of future dividends during the holding period. The market is overvalued.

Discounted Dividend Valuation Ppt Download

1 0 1 t t s t r D P Rationale.

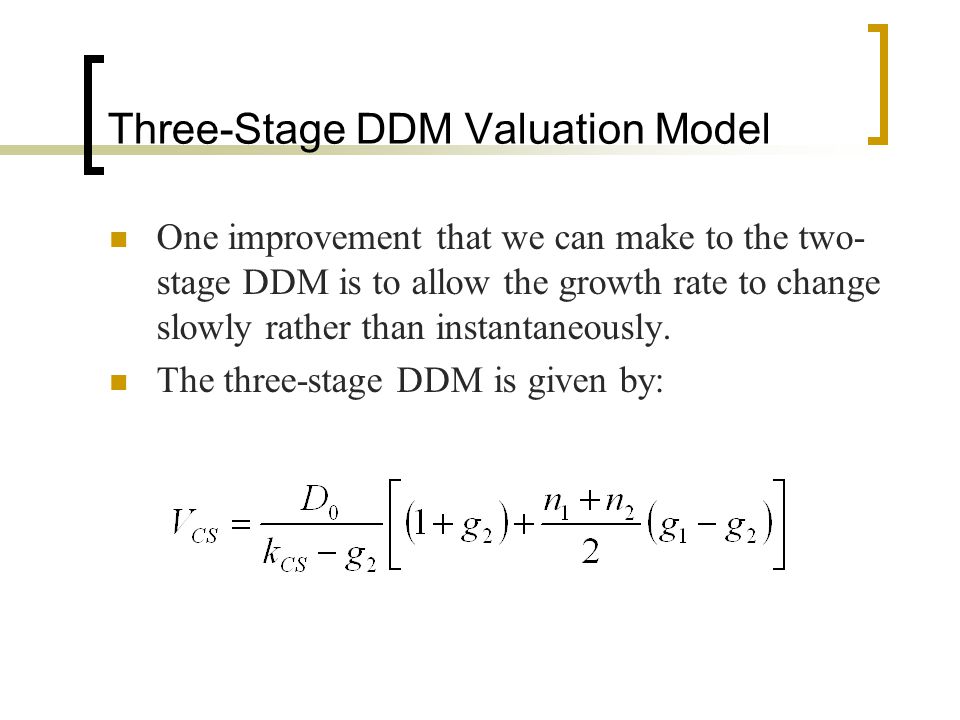

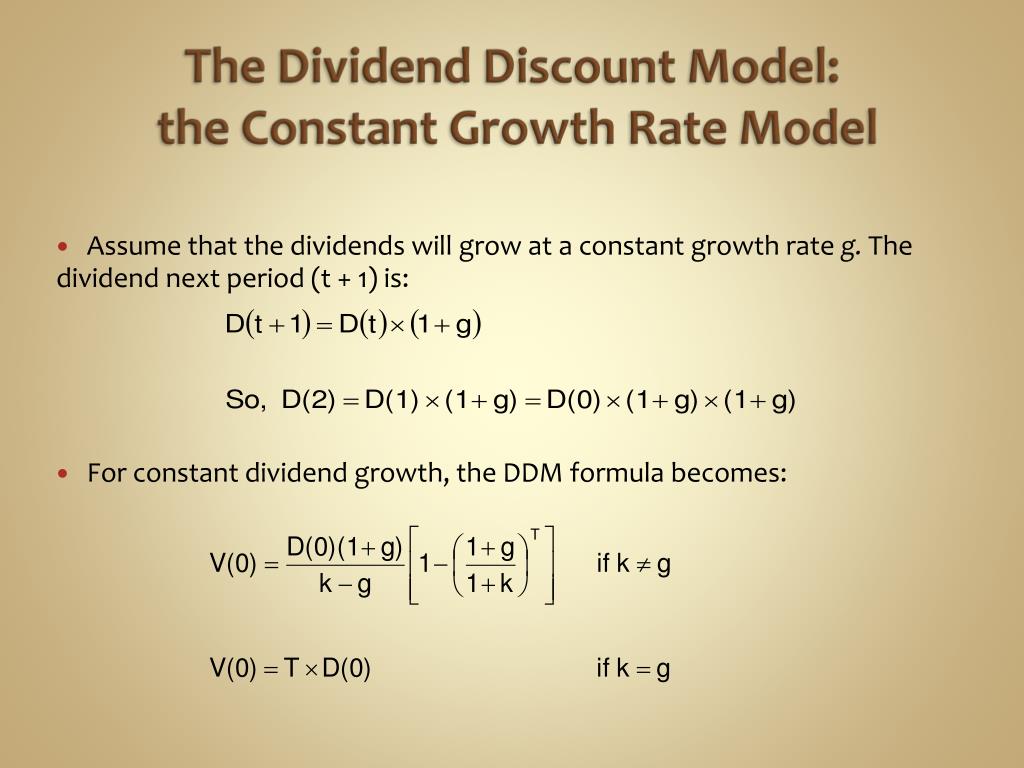

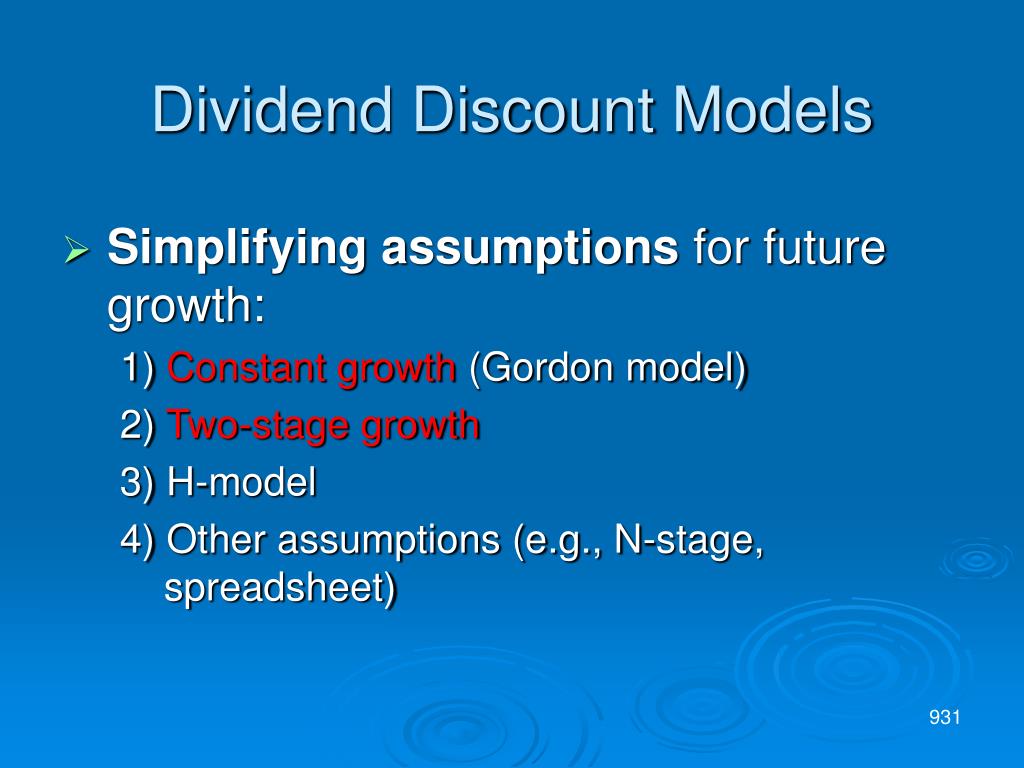

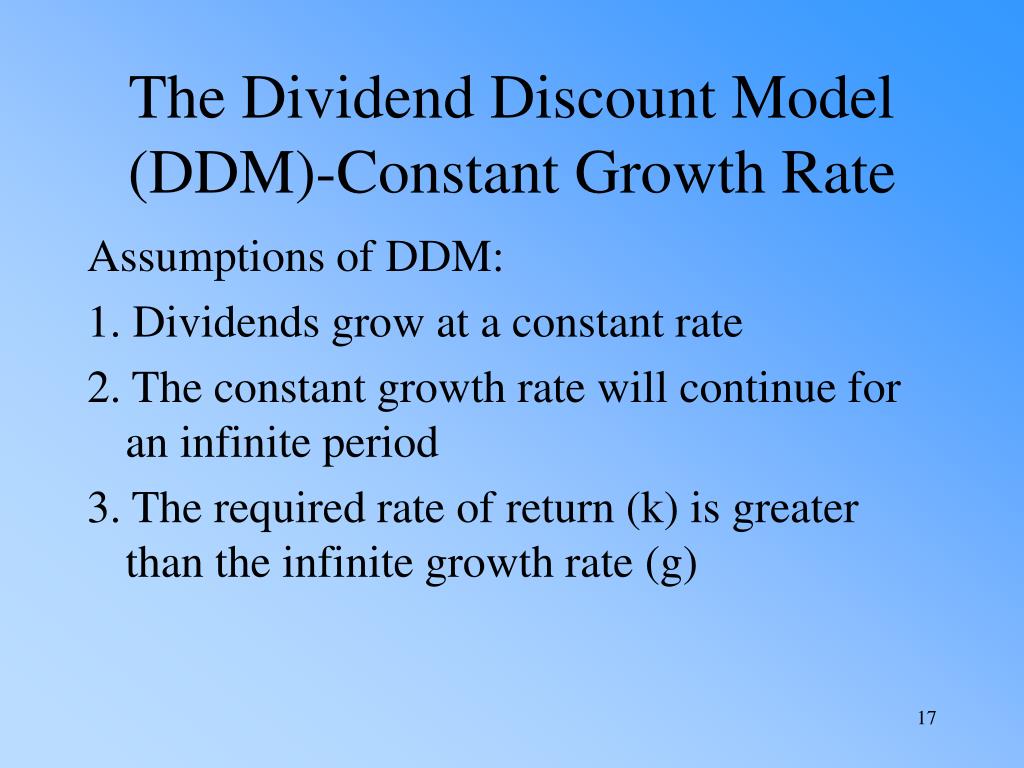

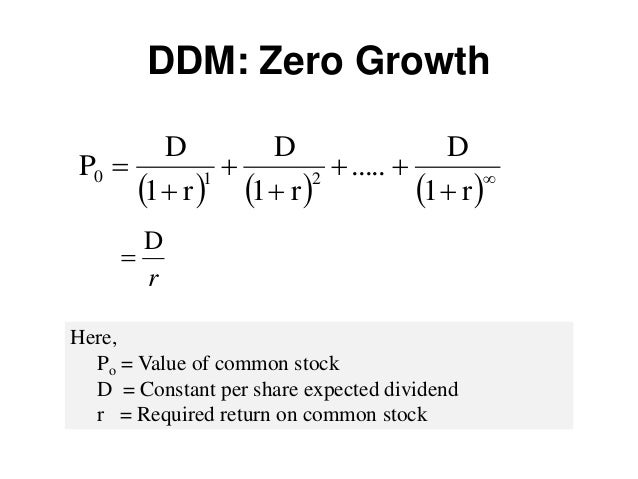

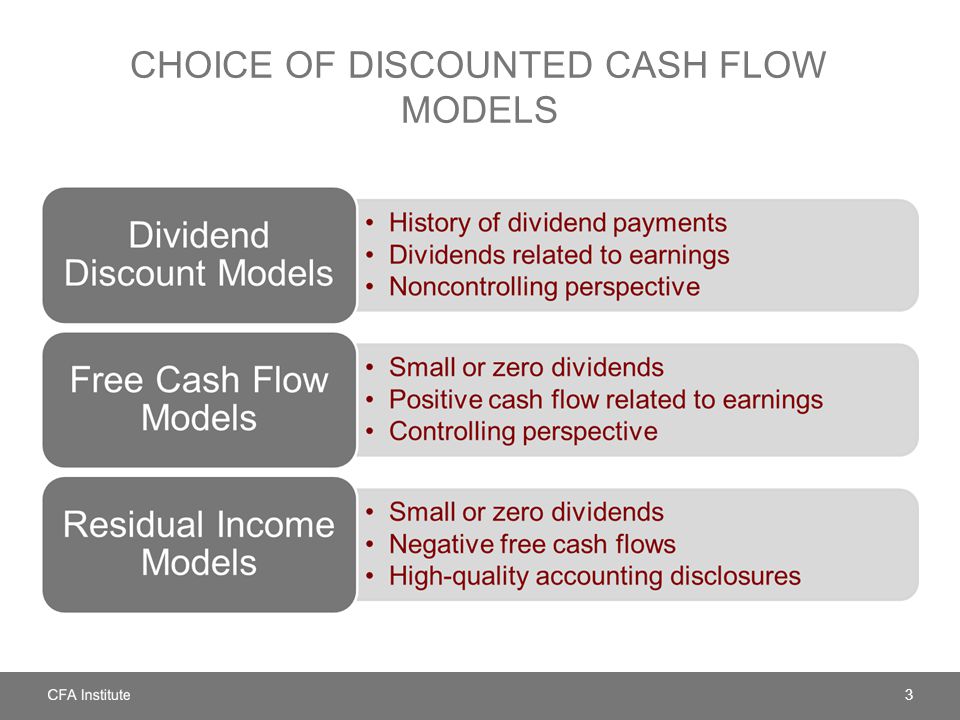

Dividend discount model ppt. DIVIDEND DISCOUNT MODELS In the strictest sense the only cash flow you receive from a firm when you buy publicly traded stock is the dividend. The general dividend discount model. Estimate the intrinsic value for the stock and compare it with the market price to determine if the stock in the market is over-priced or under-priced 1 Zero growth model the dividend growth rate g 0 It is a perpetuity model.

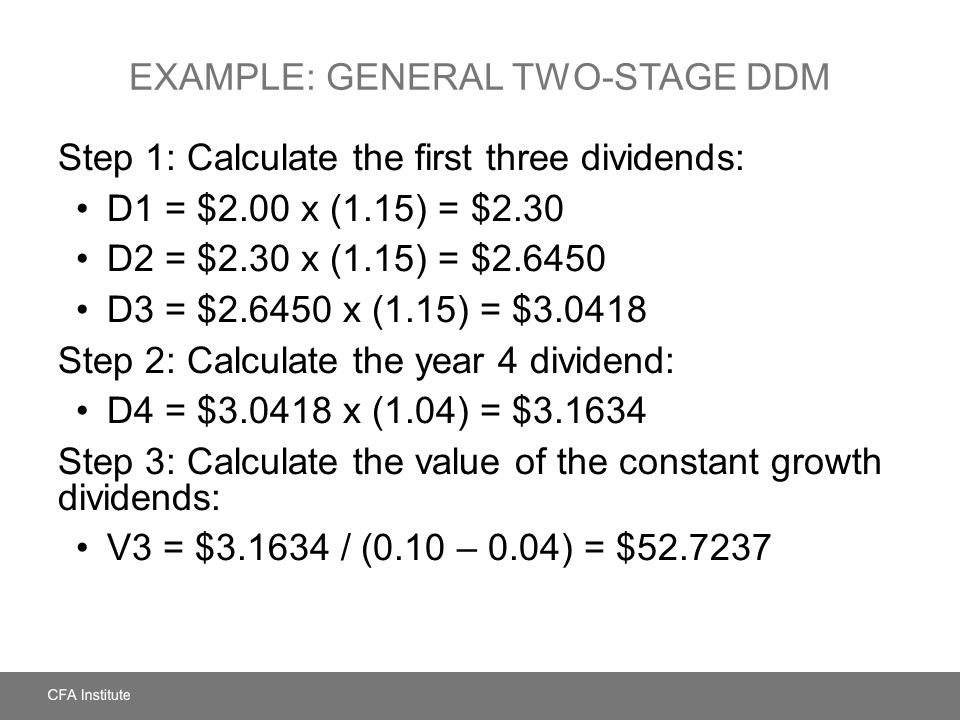

EPS x Payout 1100 x 60 660. 3 𝐷4 𝑘𝑔 P 3 138008 004 345 Step 3. Imagine a business were to pay 100 in dividends per year forever.

The dividend discount model understates the value because dividends are less than FCFE. Present value of stock at end of holding period. P market price per share DPS dividend per share EPS earnings per share r firms average rate of return k firms cost of capital.

View 15-DDMsppt from RETAILING ARS2023 at University of Malaysia Kelantan. Rs D P 0. The dividend discount model template allows investors to value a company base on future dividend payments.

The value of the firm is obtained by discounting expected cash flows to the firm that is residual cash flows after meeting all. Since the last dividend payout ratio 6001000 60 and assuming you maintain the same payout ratio then dividends per share at the end of the year is. Referred to as the dividend discount model DDM.

Compute overall intrinsic value at t0 We can now use the holding period version of the dividend discount model to calculate the intrinsic value V 0. Popular valuation model is the dividend discount model. Using an estimated dividend of 212 at the beginning of 2019 the investor would use the dividend discount model to calculate a per-share value of 212 05 - 02 7067.

Buy 500 or above and pay only 800 each. The expected growth in earnings over the next 5 years will be much higher than 8. The risk premium used in the valuation 4 is too high.

Means the Cost of Equity. 1 The required rate of return is the return demanded by the shareholders to compensate them for the time value of money and risk associated with the stocks future cash flows. The primary advantage of the dividend discount model is that it is grounded in theory.

Dividends are future cash flows for investors. Is the only model that makes a direct link between the value of the firms equity and the payoff to investors in that equity. The dividend discount model is a special case of equity valuation where the value of a stock is the present value of expected future dividends.

The expected growth in earnings over the next 5 years will be much higher than 75. With D 4 138 we can calculate P 3 as follows. The risk premium used in the valuation 4 is too high The market is overvalued.

The dividend discount model works on the principle of the time value of money. 3 Dividend Discount Model Continued. We estimated the free cashflows to equity for.

The simplest model for valuing equity is the dividend discount model -- the value of a stock is the present value of expected dividends on it. 27 A More Realistic Valuation of the Index. The justifications are rock solid and indisputable.

CHAPTER FIFTEEN DIVIDEND DISCOUNT MODELS 1 CAPITALIZATION OF INCOME METHOD THE. Dividend Discount Model DDM is a method valuation of a companys stock which is driven by the theory that the value of its stock is the cumulative sum of all its payments given in the form of dividends which we discount in this case to its present value. It is built on the assumption that the intrinsic value of a stock will show the present value of all the future cash flow or the dividend earned from a stock.

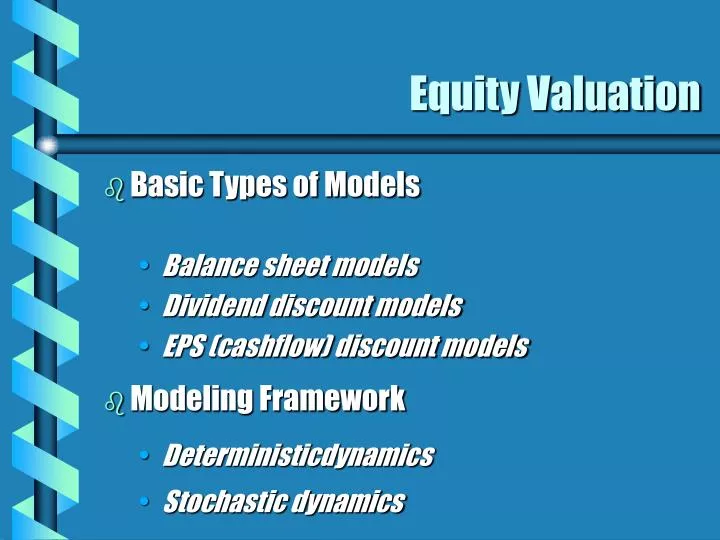

Below are the available bulk discount rates for each individual item when you purchase a certain amount. Macroeconomics Analysis Industry Analysis Equity Valuation Model Dividend Discount Model- DDM Financial Statement Analysis Macroeconomics Analysis Business Cycles Industry Analysis Business risk Industry cycles Equity Valuation Model Multistage Growth Model Illustration of two-stage Growth Model Market Value equity PE Ratio Behaviors Pitfalls in PE Analysis Earnings Forecast Financial. Walters formula for determining MPS is as followsP DPSk r EPS DPSkkWhere.

Dividend Discount Model. Buy 5 - 10 and pay only 875 each. Buy 50 - 499 and pay only 825 each.

Buy 11 - 49 and pay only 850 each. Alex decided to use the DDM model using the recent financials to arrive at the intrinsic value under three scenarios zero-growth constant growth and supernormal growth. 2 Dividend Discount Model Continued.

Dividend Discount Model Alex was able to determine the dividend per share data for the period 2015 to 2020 for Microsoft. The purpose of this article is to discuss these advantages and bring to the students attention when this model will be useful. The dividend discount model works off the idea that the fair value of an asset is the sum of its future cash flows discounted back to fair value with an appropriate discount rate.

This is based on the theory that the intrinsic value of the company is equal to all future dividends discounted back to the present day. Infinite time the firm has a very long or infinite life. Value of Common Equity.

The constant growth dividend discount model to value the dividends from t4 onward. The dividend discount model understates the value because dividends are less than FCFE. Therefore the present value of BBCs share is.

Calculate Dividend Growth Rate Ppt

Common Stock Valuation Ppt Video Online Download

Dividend Discount Model Ppt Powerpoint Presentation Portfolio Background Images Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Ppt Regular Stock Valuation Powerpoint Presentation Free Download 92543

Ppt Common Stock Valuation Powerpoint Presentation Free Download Id 6298875

Dividend Discount Model Ppt Powerpoint Presentation Portfolio Background Images Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Ppt Equity Valuation Powerpoint Presentation Free Download Id 5187858

Ppt Discounted Dividend Valuation Powerpoint Presentation Free Download Id 639008

Discounted Dividend Valuation Ppt Video Online Download

Ppt Security Valuation Learning Objectives Powerpoint Presentation Free Download Id 3351274

Ppt Topic 10 Equity Valuation Models Powerpoint Presentation Free Download Id 14699

Dividend Discount Model Ddm Of Stock Valuation

Discounted Dividend Valuation Ppt Download

Ppt Equity Valuation Dividend Discount Method With Constant Earnings Growth Rate Powerpoint Presentation Id 6162151

Dividend Discount Model Ppt Powerpoint Presentation Model Show Cpb Pdf Powerpoint Templates

Dividend Discount Model Ppt Powerpoint Presentation Model Show Cpb Pdf Powerpoint Templates

Dividend Discount Model Ppt Download

Dividend Discount Model Ddm Of Stock Valuation