Beautiful! Is Trade Discount Recorded In Journal

500 is a trade discount which is not going to be recorded in the books of accounts. In other words only the net amount of purchase or sale ie invoice price minus trade discount is recorded in the journal.

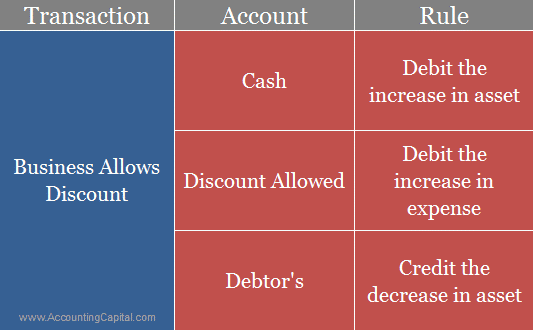

What Is The Journal Entry For Discount Allowed Accountingcapital

There is no separate journal entry for trade discount allowed or received as it is not recognized as an expense for the business.

Is trade discount recorded in journal. First of all the discount allowed on the list price of the goods ie. The transaction of salepurchase is recorded in the accounts of both parties by the discounted amount. 200 for making quick payment is a cash discount as it is allowed on the invoice price of the goods.

Discount allowed must be recorded both vendor and buyers journal. Xviii Discount allowed to customers on payment is Cash Discount. Xvi Narration should not be written in Journal.

The sale and purchase will be recorded at the amount after the trade discount is subtracted. The trade discount is simply used to calculate the net price for the customer. Journal Entry for Trade Discount.

As explained above the amount of trade discount is not recorded anywhere in the books of accounts. A Trade Discount is credited to Discount Received Account. Xvii Discount allowed on purchases by customers is Trade Discount.

However here is an example demonstrating how a purchase is accounted in case of trade discount. As this discount is deducted before any exchange takes place it does not form part of the accounting transaction and is not entered into the accounting records of the business. However here is an example demonstrating how a purchase is accounted in case of trade discount.

Trade discount is not separately shown in the books of accounts and all amounts recorded in a purchases or sales book are done in the net amount only. Journal entry for discount received is essentially booked with the help of a compound journal entry. Discount is posted to the debit of Discount Allowed Account.

The price is recorded at net of the trade discount. C Trade Discount is debited to Discount Allowed Account. Additionally where is trade discount shown.

Early-payment discounts of 1 or 2 are usually recorded by the seller in an account such as Sales Discounts and by the buyer using the periodic inventory method in an account such as Purchase Discounts Trade discounts are. In the books of the buyer it is recorded as Purchase Discount if the periodic inventory method is used of a deduction to inventory when under the periodic method. B Trade Discount is deducted from the List Price and recorded at net value.

It is usually allowed to facilitate bulk sales. For recording this transaction the net amount of Rs4000 ie. As the trade-discount is deducted before any exchange takes place it does not form part of the accounting transaction and is not entered into the accounting records of the business.

If you have any queries regarding CBSE Class 11 Accountancy Recording of Transactions 2 MCQs Multiple Choice Questions with Answers drop a comment below and we will get back. The trade discount is not normally recorded in the books of account. 5000 to MrY at a trade discount of 20.

Xix Cash Sale involving Trade Discount and Cash Discount. Vi Balance of Debtors is calculated from ledger whenever required. Instead it would only record revenue in the amount invoiced to the customer.

Trade discount We hope the given NCERT MCQ Questions for Class 11 Accountancy Chapter 4 Recording of Transactions 2 with Answers Pdf free download will help you. This type of discount is simply utilised to determine the net amount for a customer. Here is the bookkeeping entry you make hopefully using accounting software to record the journal transaction.

Trade discount is not shown in the main financial statements however cash discount and other types of discounts are shown in books of accounts. The discount afforded to the customer is 670 making the sales total for the customer 6432 6700 402 less 670 from the discount and 7102 for XYZ 6700 402. It is generally recorded in the purchases or sales book but it is not entered into ledger accounts and there is no separate journal entry.

The seller would not record a trade discount in the accounting records. No journal entry is recorded separately in the books of accounts for trade discounts. Journal Entry for Trade Discount It is generally recorded in the purchases or sales book but it is not entered into ledger accounts and there is no separate journal entry.

Journal Entry for Trade Discount It is generally recorded in the purchases or sales book but it is not entered into ledger accounts and there is no separate journal entry. MrX sells goods for Rs. In Vendor book it is treated as discount allowed and this cash discount will become loss of business and in the day book of buyer it will become discount received account which income account.

In the case of cash discounts sales are recorded at the gross amount and cash discounts are recorded as an expense. Next the discount received by James of Rs. Trade discount is not shown in the main financial statements however cash discount and other types of discounts are supposed to be recorded in the books of accounts.

How do you record trade discounts in accounting. Example for Trade Discount 10 vehicles were purchased by Unreal Pvt Ltd with a 5 trade discount on the list price of 100000 each. It is generally recorded in the purchases or sales book but it is not entered into ledger accounts and there is no separate journal entry.

Example of Trade Discounts A distributor of merchandise may have a single catalog which displays a. Trade discounts are not reflected in the accounting system of both the seller and the buyer. Discount allowed acts as an additional expense for the business and it is shown on the debit side of a profit and loss account.

Vii Journal Folio column is maintained in the ledger to show the page at which transaction was recorded in the Journal. Question Trade Discount received on purchases is recorded in the books of account as follows. Accounting for a Trade Discount.

Trade discounts are not recorded in a separate account by either the seller or the buyer. For example suppose a business sells a product with a list price of 1200 and offers a trade discount rate to a customer of 30 then the customers price is calculated using the trade discount. The entries that are shown in the sales or purchase books are recorded as the net amount.

Outstanding Ledger Journal Entries Accounting Journal

Book Keeping And Basic Accounting Accounting Journal Entries Basic

The Sales Journal Is Where You Initially Record Transactions For Sales Made By Store Credit Non Cash Transactions Ea General Ledger Good Essay Learning Math

The Difference Between The Two Sides Of An Account Is Known As An Account Balance If Accounting Capital Account Credit Account

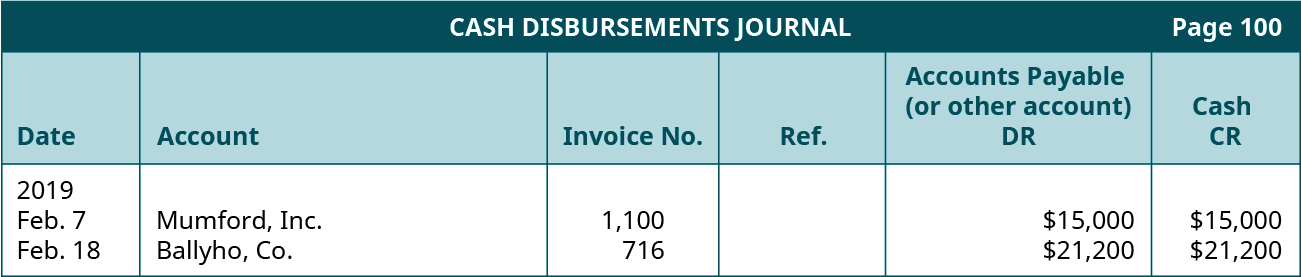

Describe And Explain The Purpose Of Special Journals And Their Importance To Stakeholders Principles Of Accounting Volume 1 Financial Accounting

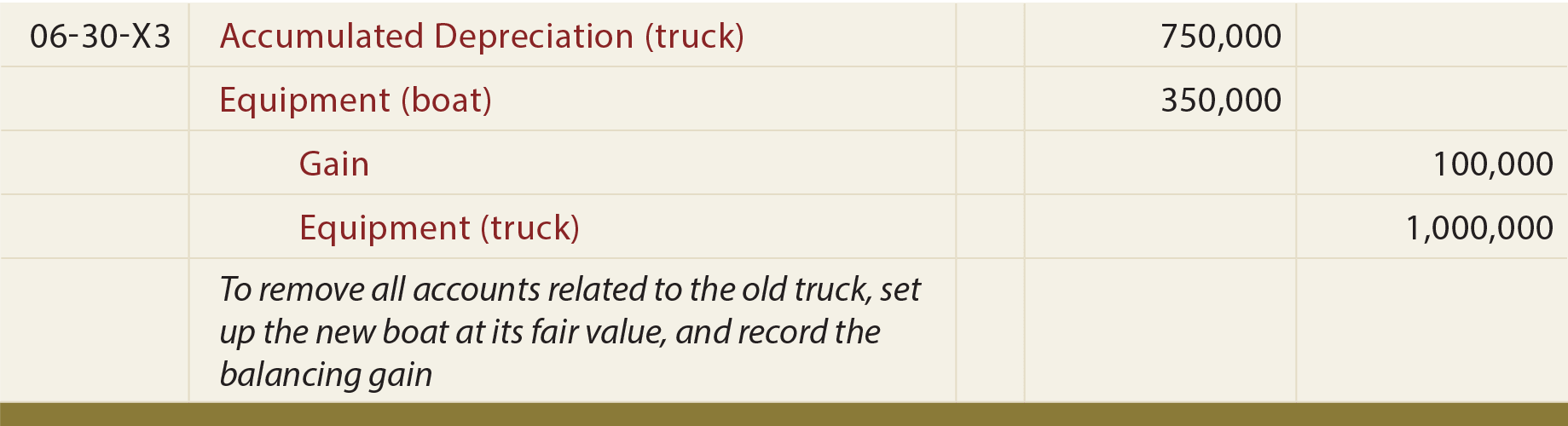

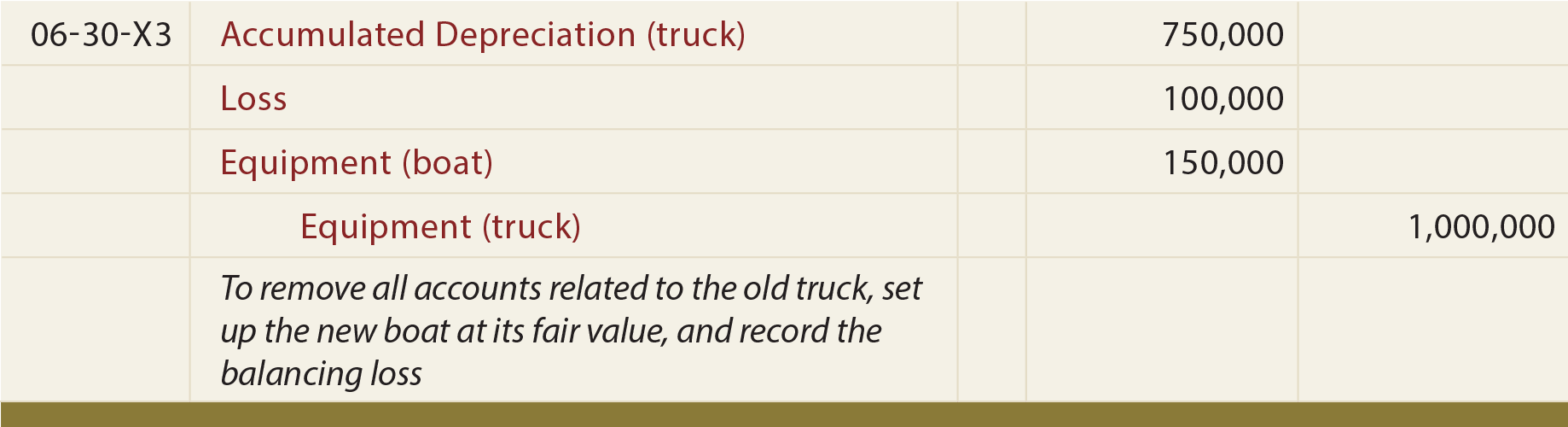

Accounting For Asset Exchanges Principlesofaccounting Com

Special Journals Accounting Basics Accounting Principles Accounting And Finance

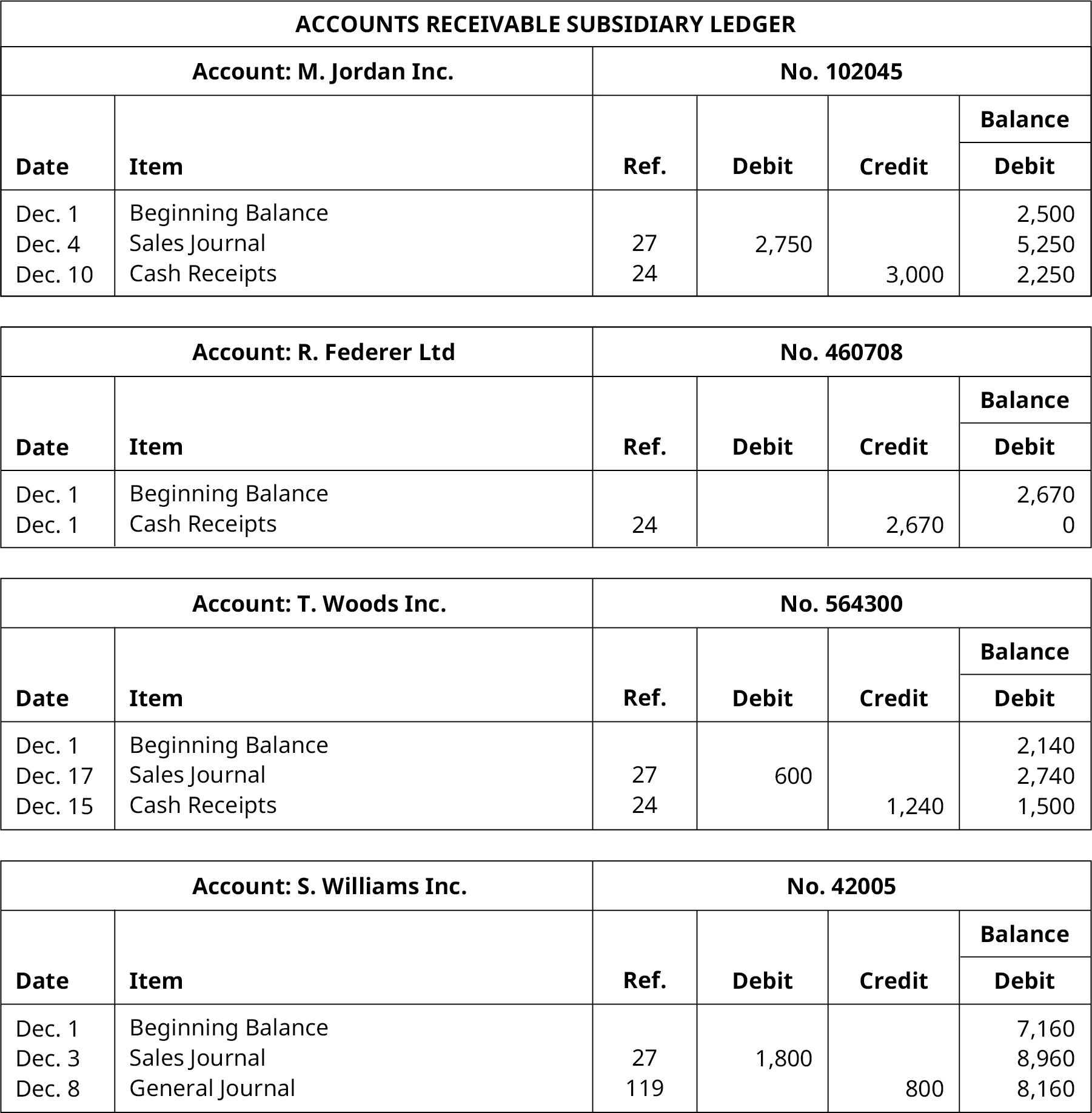

What Is Subsidiary Ledgers Accounting Accounts Receivable General Ledger

Describe And Explain The Purpose Of Special Journals And Their Importance To Stakeholders Principles Of Accounting Volume 1 Financial Accounting

General Ledger Accounting Double Entry Bookkeeping General Ledger Accounting Bookkeeping

What Is An Asset And Classification Of Assets Classification Asset Accounting

Accounting Journal Entries Examples Bookkeeping Templates Accounting Career Accounting Basics

Stock Trading Log Book In 2021 Stock Trading Value Stocks Books

Ts Grewal Solutions For Class 11 Accountancy Chapter 10 Special Purpose Books Ii Other Books Cbse Tuts Https Www Cbsetuts Com Solutions Textbook Class

Accounting For Asset Exchanges Principlesofaccounting Com

Sales Ledger Invoice Sample Invoice Sample Templates Sample

Trial Balance Trial Balance Trials Balance

The Difference Between The Two Sides Of An Account Is Known As An Account Balance If Accounting Capital Account Credit Account

Personalised Coloured Leather Journal Personalized Notebook Etsy In 2021 Leather Journal Colored Leather Distressed Leather Journal