Adorable! Discounted Sale Price Scheme

Discounted Sale Price Scheme. What is discounted sale.

The Advantages And Disadvantages Of Discounts Omnisend Blog

Subtract discount amount from list price.

Discounted sale price scheme. In one example Beardbrand which creates beard care products sells discounted bundles of their products. Multiply list price by the fraction discount. Discounted Market sale DMS Designed for first time buyers and for people without an interest in another property to get on the housing ladder.

With the Open Market Discount Scheme properties are offered for sale to eligible purchasers at a discounted price of the full market value. 13 off 120 is 80. GST is accounted for on the gross margin instead of the full value of the goods supplied.

Discounted Sale Price Scheme. 120 - 40 80. Discounted Sale Price Scheme allows you to charge 50 GST on a second-hand used vehicle.

120 - 40 80. When councils and housing associations build new homes for sale some are sold at a 25-50 discount. Discount Market Sale DMS is a low cost home ownership product where a new build property is purchased at a discounted price.

Discounted price List price - List price x fraction Example. For this discount rather than lowering the selling price of one product or service you lower the price of a group of items bought together. We have managed to negotiate exclusive mortgage deals at up to 95 of the discounted purchase price for the DMS scheme.

You do not need to seek prior approval from IRAS to use the scheme. Under the Discounted Sale Price Scheme you can charge GST on 50 of the selling price when you sell a second-hand used vehicle. JDCIFA is the biggest provider of mortgages for DMS schemes in the Country and was at the forefront of its introduction.

Approved Contract Manufacturer and Trader ACMT Scheme. You do not need to seek prior approval from IRAS to use the scheme. This is known as a Discounted Sale.

To buy a home through a shared ownership scheme contact the Help to Buy agent in the area where you want to live. GST charged on 50 of the sale price of a second-hand or used vehicle. Approved Refiner and Consolidator Scheme ARCS Approved Third Party Logistics 3PL Company Scheme.

For example a 100000 house with a 25 discount would be offered to eligible applicants for 75000. Sale price is 13 off list price of 120. It has been set up to manage the sale and re-sale of this type of affordable.

Import GST Deferment Scheme IGDS allows you to pay GST on imports when your monthly GST returns are due instead of at the point of importation. This is not a shared ownership scheme and even though there is a discount on the sale price the purchaser still owns 100 of the property. Under the Discounted Sale Price Scheme you can charge GST on 50 of the selling price when you sell a second-hand used vehicle.

The discounted sale housing scheme was first launched in 2010 and was previously known as the Homeseekers Register. This discount is usually around 20 and the. Discounted Sale Price Scheme.

Discounted Sale Price Scheme is a scheme for the sale of a second-hand motor vehicle whereby GST is charged on 50 of the selling price of the vehicle. Ownership goals the Council operates a discounted sale scheme to manage the sale of low cost home ownership properties secured through Section 106 planning obligations. Discount Market Sale DMS also known as Council Shared Equity or reduced market value scheme is a low cost home ownership product where you can buy a new build or existing property at a discounted price from a local council participating in the scheme in collaboration with developers who are often housing associations.

You do not need to seek prior approval from IRAS to use the scheme. This scheme allows you to buy a newbuild property at a discount against the market value but when you come to sell the same discount is. Under this scheme you are required to charge GST on 50 of the selling price when you sell the used vehicle.

Approved Import GST Suspension Scheme AISS Approved Marine Customer Scheme AMCS Approved Marine Fuel Trader MFT Scheme. This is beneficial for second-hand dealers who purchased goods free. 120 - 12013.

If you are not a motor vehicle dealer you should use the Discounted Sale Price Scheme when you occasionally sell a vehicle that you have used in your business. Under the Discounted Sale Price Scheme you can charge GST on 50 of the selling price when you sell a second-hand used vehicle. Discounted Sale Price Scheme.

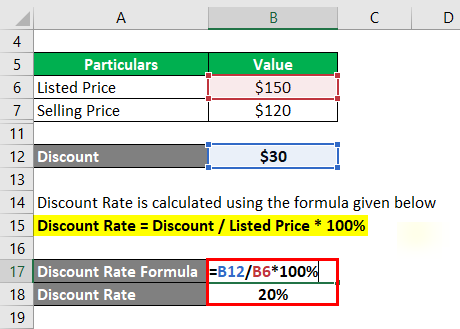

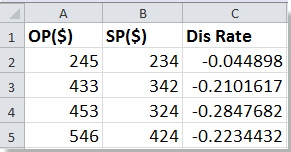

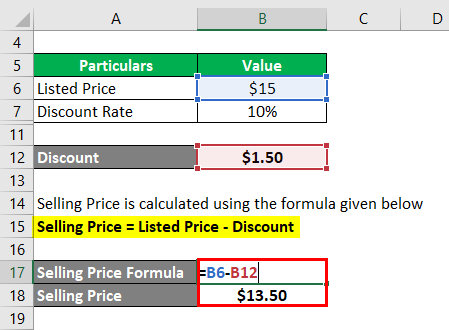

Discount Formula Calculator Examples With Excel Template

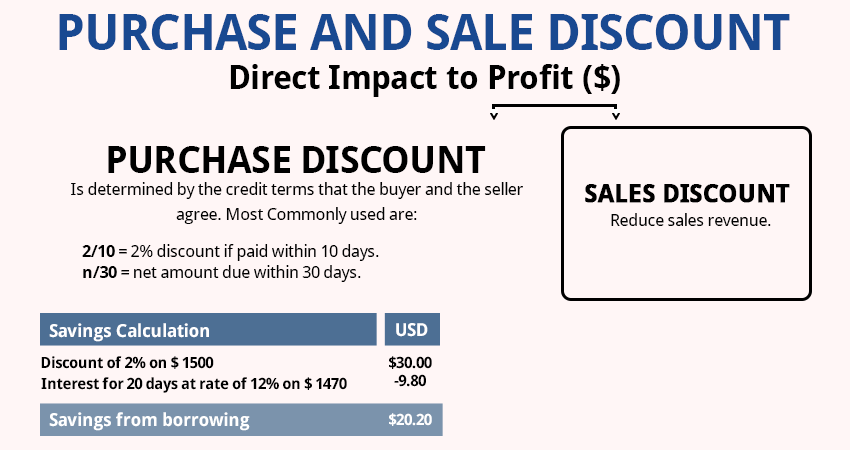

Difference Between Sales Discount And Purchase Discount

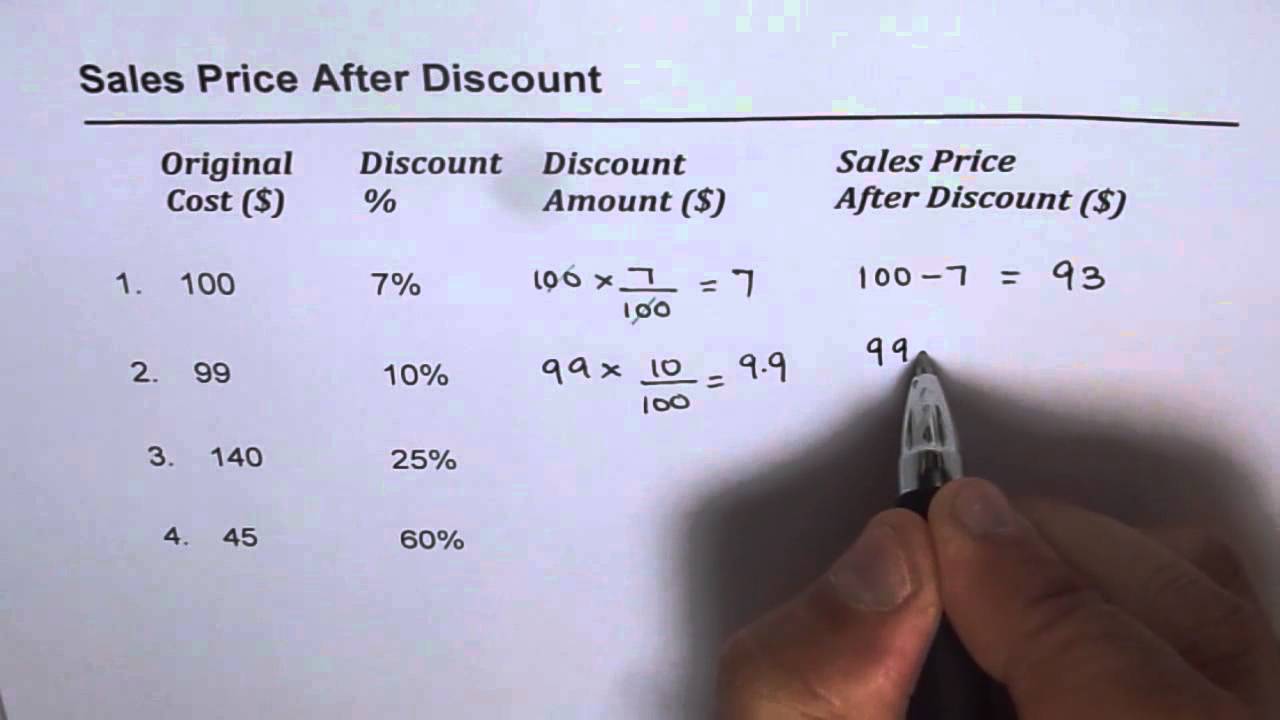

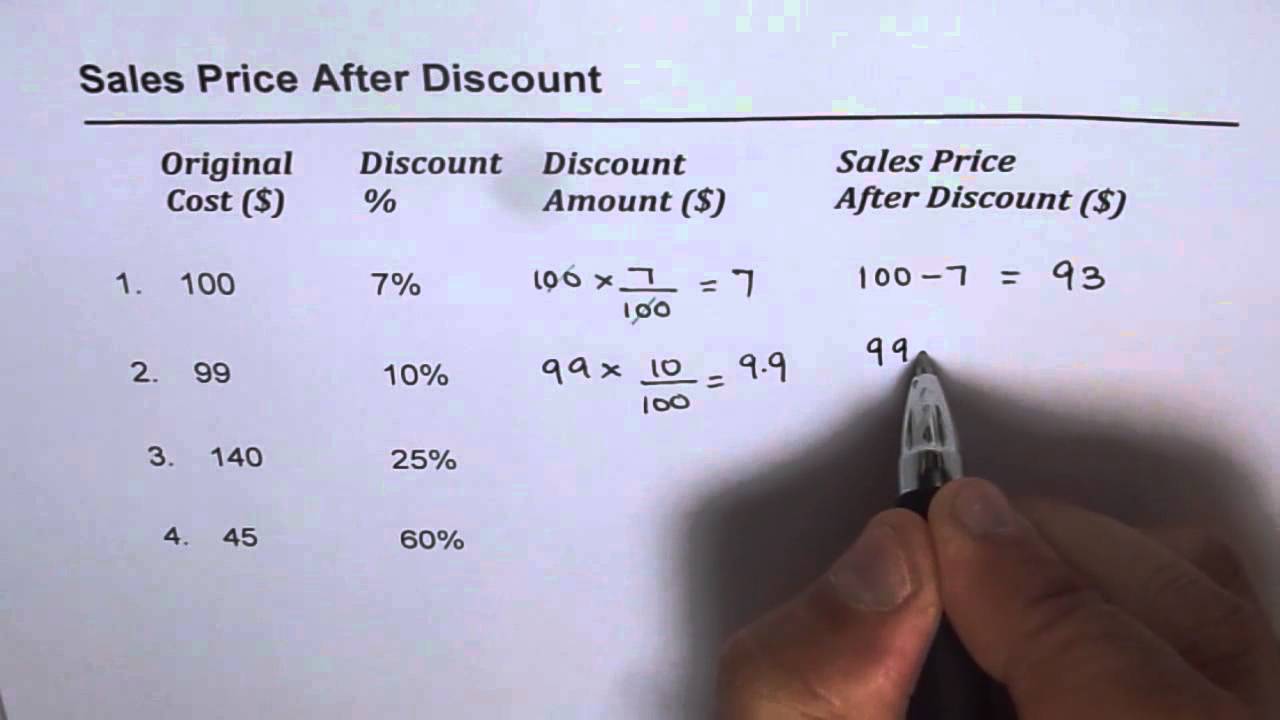

How To Calculate Sales Price After Discount Youtube

Discounts Discount Rates Formulas Types

Discount Formula Finding The Discount And Original Price Youtube

Advantage And Disadvantage Of Discount Pricing Assignment Point

6 1 Figuring Out The Cost Discounts How Much Mathematics Libretexts

How To Calculate Percentage Discount Video Lesson Transcript Study Com

Difference Between Sales Discount And Purchase Discount

Difference Between Sales Discount And Purchase Discount

Calculating A 10 Percent Discount How To Steps Video Lesson Transcript Study Com

Discount Formula Calculator Examples With Excel Template

Woocommerce Dynamic Pricing With Discount Rules Plugin For Bulk Discounts Pricing Deals

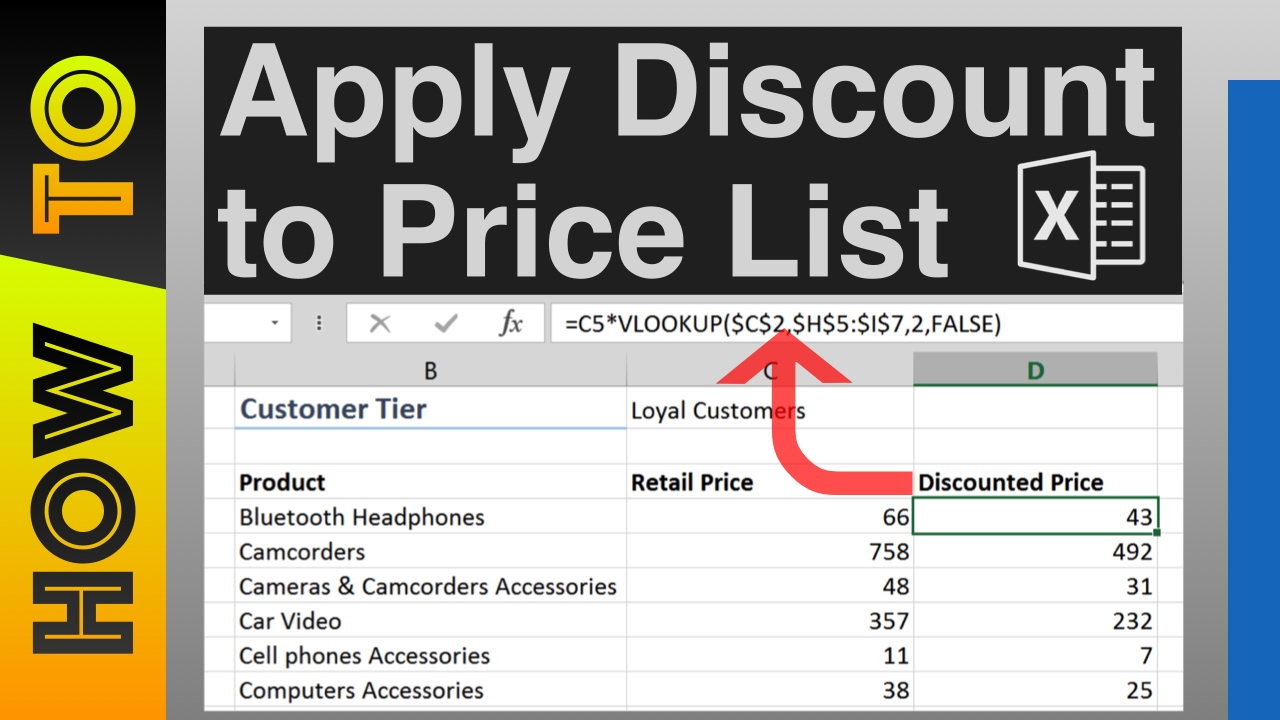

How To Calculate Discount Rate Or Price In Excel

The Best Sales Campaign Ideas Templates To Increase Your Revenue

What Is A Pricing Sheet How To Make One Examples

How To Apply Discount To Price List For Different Customers In Excel Youtube

How To Calculate Percentage Discount Video Lesson Transcript Study Com

Discount Formula Calculator Examples With Excel Template